Blog entry by Lester Bleakley

Each one of us has been using the Internet for a long time. Internet is a store of unlimited information on any subject. You just need to browse through various websites available and can get any information you want. But do you know you can get a loan online too. Yes, I am talking about "Online Loans".

The borrowers, who in the past have defaulted or made late payments in one or more circumstances, are considered people with poor credit rating. They may be burdened with arrears, county court judgments or may have even filed for bankruptcy. These people are classified as a great risk by many loan lenders. However, this is no longer the truth today. Even these people can easily get a loan by proving their repayment ability and convincing the lenders.

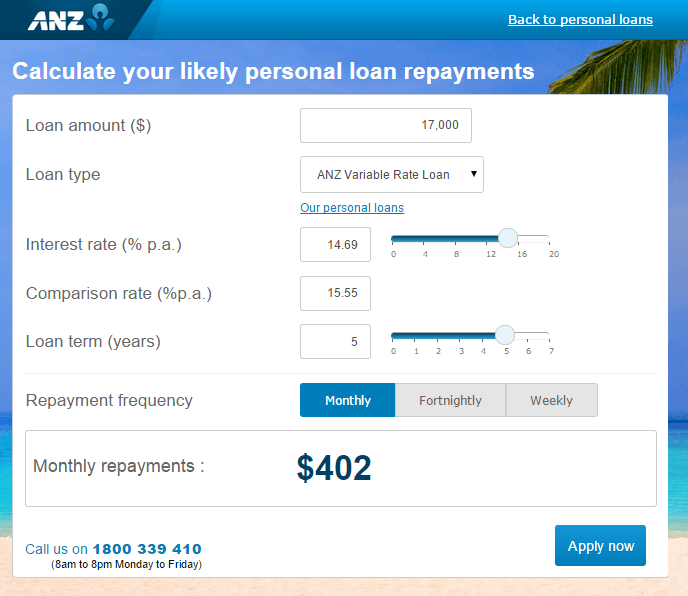

First things first, the first step to auto loans bad credit is to self-analyze. You have to do an analysis how much you can afford monthly. Make sure not to put extra pressure on your current budget and extra stress on yourself. Then you can check one of the online lenders for various plans. You can also use one of their Free Loan Calculators. Check the feasibility of their plans.

Sub prime fast home loans offer twofold advantages. You can buy the car you want. You can then repay the loan in easy installments to improve your credit score. Some money lenders may charge some up-front fee while approving your loan proposal. To get the best deal in the Sub prime auto loans sector, you need to conduct a careful research using the tools available on the websites of different money lenders.

A car loan is a loan that enables you to buy a car when you don't have the cash to pay the full amount. Some lenders have stipulations about how you spend the money they give you. You may be limited to doing business only with authorized dealers. Other lenders will allow you to buy a car at an independent dealership. It may be tougher to find a lender who will allow you to get a loan for a car you find on the private market. But there is a loan out there that will suit your needs.

Depending on the result of the debt consolidation loan calculator, you can choose to consolidate your Loan calculators, refinance it, or use other settlement options.

Cars can gift you a joyful ride. It saves your time, makes you feel proud and what not. But purchasing a car of your own is no kidding. It needs a big amount of money to buy it. In this regard you can take car loans which are easily available in the loan market. Now what if you are having poor credit score? No problem, poor credit car loans are available in the loan market which is always ready to help guaranteed poor credit auto loan credit holders. Here are a few lines about poor credit car loans.

It is also likely to be required to prove your identity and banking information. A current checking account and routing numbers may be mandatory. Quite often loans are directly deposited into your account as well as the monthly repayments with drawn. Some lenders will also check your credit history and score, especially if the loan you are requesting is unsecured. You collateral will also need to be verified to be sure that the value is equal or above the amount you are asking borrow.

If you treasured this article and you simply would like to collect more info with regards to comment-67419 generously visit the site.