Blog entry by Marissa Travis

There are several ways to get a loan when you need to buy a car. Take time to look around. With so many options you will find a loan that fits your personal needs. You can get a car loan at your local bank or credit union. Or you can look online. There are numerous sites dedicated to lending. There are also sites that act a gathering place for lenders. These are called networks. You can submit one application and get several quotes from different lenders. Keep an open mind about your loan options.

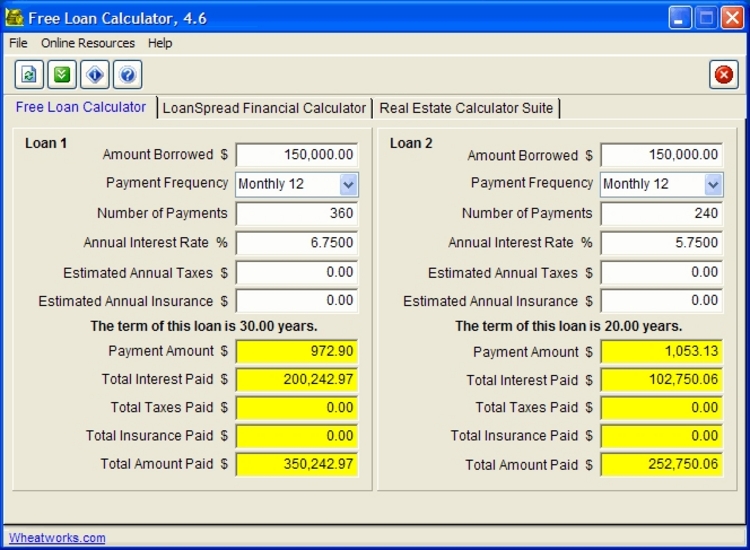

There is help available on the websites. You can use the comparison charts or the Online loan Calculators for calculating the amount and interest as well as repayment period that fetches the monthly installment to the amount you want. You may also have an online chat with one of the representatives of the online money lenders so that you get an exact idea.

Often, the best strategy for those who are heavily indebted is to apply loans for debt consolidation. This loan puts all your debts in a single credit. You only pay one lender monthly; in turn, this lender pays all your other creditors. Loans for debt consolidation usually have lower interest rates compared with your credit card or personal loan rates. The term is also longer, which gives you the flexibility to manage your finances.

Make sure to sit down and figure out just how much you can afford to pay every month, rather than doing this in the auto dealer's office. Go over everything and make sure your payments will be comfortable and not stress the household budget. There are dozens of Free Loan internet calculators online and you can figure in the interest rate and term of the auto loan to easily figure out what your monthly payment will be.

The point to this is to use this kind of information to gauge the quality of the home loan being offered. You want the best after all. Your home will be an asset. Don't let your excitement about the first offer on a home saddle you with problems down the road. Never accept the first offer that comes your way. This loan will be a long-term payment. You want to secure the best possible price.

Improves your credit score. A bad credit auto loan will improve your credit. Once you are approved for the loan and begin making regular payments, you will see an improvement in your credit score. This is because your debt will be decreasing and you are showing you can pay each month and on time.

Searching online can give you so many different options and is the best place to start looking. Make a list of your questions and needs before your search starts. Knowing ahead of time what you need will make the process of finding the best lender much easier. There are also many loan calculators available online. These tools will help you run the numbers of what you can afford and what type of loan will work best for you without ever talking to a lender. Having this information ahead of meeting with a student loan consolidation lender will give you more power in the conversation and make it easier for you to really make sure you needs are met.

If you have any inquiries relating to where and how you can use qualify for debt consolidation loan, you can contact us at our webpage.