Blog entry by Lester Bleakley

A settlement loan is money that you borrow to consolidate or settle your debts. With this type of loan you can consolidate all your monthly payments into one that is often lower than the total of all the payments. The benefit is that you have more money left at the end of the month when you pay all your bills.

We

need to calculate the approximate annual property tax rate. This

figure will vary not only by region but also within regions. In

California we can start with a normal base rate of 1.25%

annually. By taking 1.25% multiplied by the target sales price of

$250,000 and divided by 12 months we arrive at a property tax

figure $260.42 we can use in our initial calculation.

The borrowers, who in the past have defaulted or made late payments in one or more circumstances, are considered people with poor credit rating. They may be burdened with arrears, county court judgments or may have even filed for bankruptcy. These people are classified as a great risk by many loan lenders. However, this is no longer the truth today. Even these people can easily get a loan by proving their repayment ability and secured loans convincing the lenders.

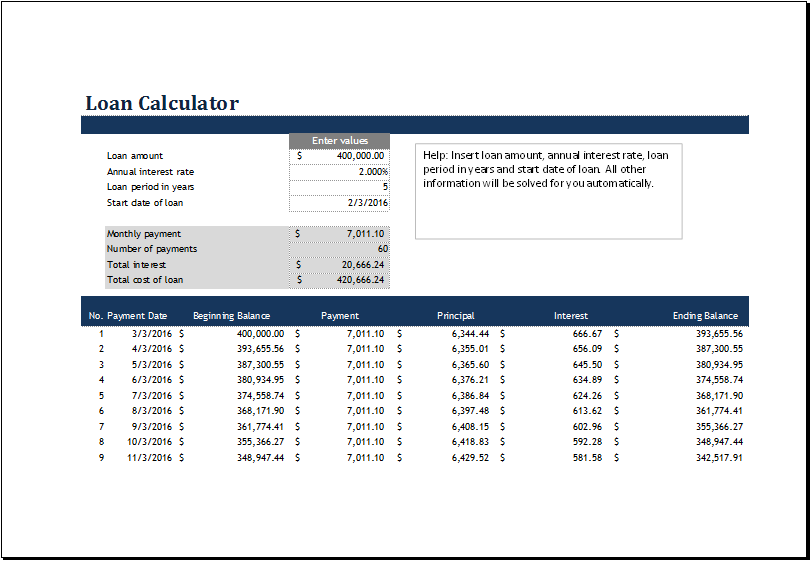

There are a number of free calculators available Loan calculators. These are very easy to use and offer a fast and effective way to help you organise your finances. You can use these online calculators to compare loan deals that are available both online home loan comparisons and offline. All you will need is the basic details of the deal including the APR rate and the loan term.

Now, you can access the Internet and can browse through various websites to get an online loan. You need not meet each and every lender personally. The websites are open 24 hours a day, 7 days a week and 365 days a year. These websites also provide you with facility to calculate your credit score, Free Loan Calculators of cost or for nominal charges.

Traditional brick and mortar lenders such as banks or credit unions are not going to grant you a five-figure loan. They have tightened their credit benchmarks and even good credit borrowers have a hard time finding loans with them, even if they are home owners. Because of this, many private lenders have stepped into the lively market and will work with bad credit borrowers. Most of these lenders can be found online and there are scores of them. Competition can be rather fierce.

You should be aware that there are numerous lenders providing bad credit used auto loans to people with poor credit rating. Hence, good research and comparisons can fetch you a lower rate.

The things which you must be careful about are the rate of interest that you are going to pay. The rate differs for the different lenders. So, it is always better to shop around a little before you apply. This will save a lot of money in your future. The Annual Percentage Rate is the second thing which you should look after. The APR tells you exactly how much you are going to repay the financer at the end of the loan term.

In case you loved this article and you want to receive details

concerning photozou.jp kindly

visit our web page.